Novatus En:ACT: Ensuring AccurateCompleteTimely Transaction Reporting

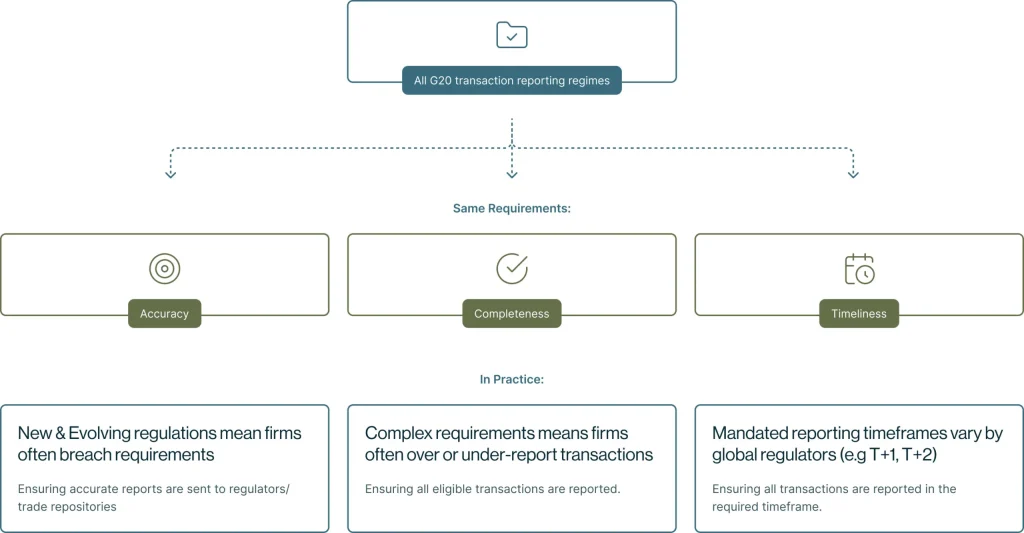

A fully scalable technology platform trusted by major global firms to reconcile both source systems and submission files and for all G20 transaction reporting regimes.

Different regulations:

Modular Global Coverage

Full G20 Coverage, delivered in modules for ease of scalability.

A purpose built SaaS platform to ensure firms report in an accurate, timely and complete manner, avoiding fines and remediation programmes.

En:ACT was developed to ensure firms meet their global reporting requirements without the need for ongoing remediation programmes.

Accuracy

Our proprietary compliance rules engine can test 100% of trades, and 100% of fields, against all global regimes, and is fully maintained by our in-house team of experts

We ensure demonstrable compliance by providing clear linkage back to the underlying regulatory text

Completeness

Using the Novatus eligibility logic to determine transaction eligibility provides an independent view of which transactions are reportable, and to which jurisdictions

This means we can independently assess each transaction to ensure no over-or under-reporting, no matter where the trade data originates from

Timeliness

Providing insight into whether transactions have been reported on time, based on the reporting deadline for each reportable jurisdiction

Our platform has been purpose-built to solve the challenges our clients have faced over years of error reporting and remediation. We understand the challenges and our clients – that is why we are trusted by global banks and asset managers.

We transform the daunting process of obtaining regulatory approval into a streamlined, stress-free experience. Our seasoned experts not only handle the intricate details of application preparation (including Regulatory Business Plans and financial analysis) and compliance but also provide strategic insights to ensure application success.

We transform the daunting process of obtaining regulatory approval into a streamlined, stress-free experience. Our seasoned experts not only handle the intricate details of application preparation (including Regulatory Business Plans and financial analysis) and compliance but also provide strategic insights to ensure application success.

We transform the daunting process of obtaining regulatory approval into a streamlined, stress-free experience. Our seasoned experts not only handle the intricate details of application preparation (including Regulatory Business Plans and financial analysis) and compliance but also provide strategic insights to ensure application success.

We transform the daunting process of obtaining regulatory approval into a streamlined, stress-free experience. Our seasoned experts not only handle the intricate details of application preparation (including Regulatory Business Plans and financial analysis) and compliance but also provide strategic insights to ensure application success.

We transform the daunting process of obtaining regulatory approval into a streamlined, stress-free experience. Our seasoned experts not only handle the intricate details of application preparation (including Regulatory Business Plans and financial analysis) and compliance but also provide strategic insights to ensure application success.

We transform the daunting process of obtaining regulatory approval into a streamlined, stress-free experience. Our seasoned experts not only handle the intricate details of application preparation (including Regulatory Business Plans and financial analysis) and compliance but also provide strategic insights to ensure application success.

We transform the daunting process of obtaining regulatory approval into a streamlined, stress-free experience. Our seasoned experts not only handle the intricate details of application preparation (including Regulatory Business Plans and financial analysis) and compliance but also provide strategic insights to ensure application success.

Established in 2019, Novatus En:ACT was built in collaboration with a major global banking group, with the goal of solving clients’ most significant Transaction Reporting challenges that persisted with existing market solutions.

Built as a pure SaaS solution upon AWS infrastructure, it is scalable, rapidly deployable and is fully interoperable to existing technology, structures & processes.

AWS Hosted

Rapid implementation with data hosted locally in your region

Real-time MI

A tailored reporting suite of metrics & KPIs displayed in real-time

Enhanced traceability

Precise identification of errors tied back to regulatory text

Modular global coverage

Full G20 regime coverage, delivered in modules for ease and scalability

Novatus En:ACT Demo #1 – Submission File Assurance

Join Ryan Jones, Senior Data Analyst, as he showcases En:ACT’s submission file assurance capabilities. This demo highlights the platform’s intuitive file uploads, data visualisation, and robust rules engine. Learn how En:ACT ensures compliance through transparent, regulation-linked testing while supporting effective root cause analysis for your regulatory reporting needs.

Source system and submission file reconciliation

Back reporting corrects delayed or erroneous financial transactions to ensure compliance, data integrity, and operational efficiency.

Submission file reconciliations

Back reporting corrects delayed or erroneous financial transactions to ensure compliance, data integrity, and operational efficiency.

Pre-submission file assurance

Back reporting corrects delayed or erroneous financial transactions to ensure compliance, data integrity, and operational efficiency.

Join the many organisations we’ve helped to transform their transaction reporting